Insurance Claims

Insurance plays a pivotal role in providing individuals and businesses with a safety net in the face of unforeseen challenges. It serves as a financial safeguard against an unexpected event, and having an experienced insurance claim lawyer can make a significant difference. Whether it be the aftermath of a natural disaster, instances of bad faith practices by insurance companies, or property damage, understanding the fundamental concept of insurance becomes crucial.

Seamless Insurance Claims Solutions from Ethen Ostroff Law's Insurance Claim Lawyer

Insurance plays a pivotal role in providing individuals and businesses with a safety net in the face of unforeseen challenges. It serves as a financial safeguard against an unexpected event, and having an experienced insurance claim lawyer can make a significant difference. Whether it be the aftermath of a natural disaster, instances of bad faith practices by insurance companies, or property damage, understanding the fundamental concept of insurance becomes crucial.

At its core, insurance is a contractual arrangement between an individual or entity and an insurance company. In exchange for regular premium payments, the insurance company agrees to provide financial protection or reimbursement for covered losses. This arrangement is designed to mitigate the financial impact of unprecedented events, offering policyholders a sense of security and peace of mind.

The uses of insurance are diverse, encompassing various aspects of life and business. For individuals, insurance can include auto insurance, health coverage, homeowners insurance, and life insurance, among others. These policies ensure that individuals are not left financially vulnerable in the face of medical emergencies, accidents, or property damage. In the business realm, insurance extends to areas such as business interruption insurance, liability coverage, and property insurance. These policies safeguard businesses from legal liabilities, property damage, and disruptions to operations, allowing for continuity even in challenging circumstances.

Now, as we delve into an immersive journey through the complex landscape of insurance claims with Ethen Ostroff Law, the significance of insurance becomes even more pronounced. Our dedicated team of insurance claim lawyers is poised to guide you through the intricacies of this process, ensuring you are empowered at every step.

Within this comprehensive guide, explore the specific areas of insurance claims that Ethen Ostroff Law specializes in, namely bad faith claims, hail damage, home damage, hurricane damage, property damage, and windstorm damage. Each section provides invaluable insights meticulously crafted to empower you through the most challenging of times.

From recognizing signs of bad faith practices to untangling the complexities of distinct claims such as hail damage, home damage, and hurricane damage, our commitment to your empowerment remains unwavering. Ethen Ostroff Law is not merely a legal resource but a committed partner dedicated to guiding you towards fair and just compensation.

As you delve into the intricacies of insurance claims, rest assured that each section unveils essential insights into the multifaceted world of insurance. Our team stands as your advocate, deftly navigating negotiations, assessments, and settlements. Your journey towards securing equitable compensation begins here at Ethen Ostroff Law.

Trust our seasoned insurance claim attorneys to be your allies, ready to champion your cause with the expertise, commitment, and determination needed to navigate the complexities of insurance claims successfully. Feel empowered to delve into this wealth of knowledge, secure in the knowledge that Ethen Ostroff Law is not just a legal representation but a partner in your pursuit of justice.

To read the full article and explore seamless insurance claims solutions, turn the pages, and empower yourself with knowledge. Ethen Ostroff Law is here to guide you through every step of your insurance claim journey.

Understanding Property Damage Insurance Claim with Ethen Ostroff Law

Property damage encompasses the harm or loss suffered by tangible assets, including homes, commercial buildings, and personal belongings. This damage can result from various incidents, such as natural disasters, accidents, or other unforeseen events. Property damage insurance claim, in turn, serves as a financial safety net designed to protect individuals and businesses from the financial fallout of such occurrences.

The primary purpose of property damage insurance is to provide a source of recovery and compensation when your property sustains harm. Whether it’s damage to your residence or commercial space, this insurance serves as a crucial means of regaining financial stability in the aftermath of unexpected events. Different types of insurance policies cover property damage to personal or commercial property, ensuring a wide range of assets can be safeguarded.

Understanding the intricacies of property damage insurance coverage is essential for a successful claims process. Key aspects, such as the types of damage covered and the documentation required, play a pivotal role in determining the outcome of your claim. Effectively filing property damage claims involves practical knowledge, including awareness of the timelines for initiating a claim to ensure a prompt resolution.

Despite the protective nature of property damage insurance, challenges may arise in the form of claim declinations and rejected property damage claims. It’s crucial to comprehend the circumstances under which a property insurance claim might be rejected and how insurance companies challenge claims. In such situations, the involvement of a property damage insurance claim lawyer becomes pivotal in overturning denials.

Unlock the secrets of property damage insurance claims with Ethen Ostroff Law, your trusted partner in navigating the complexities of property damage and securing the compensation you deserve. Delve into a comprehensive exploration of property damage, uncovering key insights to empower you through every step of the property damage insurance claims process.

Learn the fundamentals: what property damage is and what constitutes a property damage claim. Explore the various types of property damage that can impact your assets, from residential homes to commercial properties. Discover the types of insurance policies that cover property damage to personal or commercial property. Unravel the intricacies of property damage insurance coverage, understanding the key aspects that determine your claim’s success. Gain practical knowledge on how to file property damage claims effectively. Learn about the timelines involved and how soon you can initiate a property damage claim to ensure a swift resolution.

In the face of challenges, explore the potential hurdles, including claim declinations and rejected property insurance claims. Understand the circumstances under which a property insurance claim might be rejected and how insurance companies challenge claims. Finally, discover the pivotal role of a property damage insurance claim lawyer in overturning denials. Learn why Ethen Ostroff Law is your go-to choice for denied property damage claims and how our team can tip the scales in your favor.

Empower yourself with knowledge and take control of your property damage insurance claim. Continue reading on and turn to the pages of this article to delve into the intricacies of property damage and insurance claims and how Ethen Ostroff Law can secure the compensation you rightfully deserve.

The Ultimate Guide to Successful Hail Damage Insurance Claim in 2023

Filing a hail damage insurance claim becomes crucial in the aftermath of a hailstorm. Hailstorms, characterized by the fall of ice pellets or hailstones, can cause substantial damage to structures, vehicles, and vegetation due to the impact of hailstones during a hailstorm. These storms arise when updrafts in thunderstorms transport raindrops into frigid atmospheric zones, leading to freezing and hailstone formation. Hailstones can vary in size, from small pellets to larger, more destructive pieces.

Hail damage insurance is specialized coverage, safeguarding individuals and businesses from financial losses resulting from hail damage. Covering repair or replacement costs for damaged structures, vehicles, and assets, this insurance acts as a financial safety net for recovery after a hailstorm.

Navigating the aftermath of a hailstorm involves filing a hail damage insurance claim, documenting the damage extent, initiating communication with the insurance company, and following claims assessment and settlement procedures. Successfully handling a hail damage insurance claim entails understanding insurance intricacies, meeting documentation requirements, and adhering to specific timelines.

As we understand and navigate the complexities of hail property damage claims, Ethen Ostroff Law stands as your guiding light through the storm. Our comprehensive guide dives into the fundamentals, revealing the true nature of hail and its widespread impact, particularly in the top 10 states most susceptible to these icy tempests.

Gain a deeper understanding of the aftermath of hailstorms as we provide insights into common property issues caused by hail. From dents on vehicles to structural damage on roofs, our guide equips you with essential knowledge to recognize and address the consequences of a hailstorm. Beyond identification, we offer practical tips on preventing or minimizing hail damage to your property, empowering you to fortify your assets against the unpredictable forces of nature.

In the heart of our comprehensive guide lies a dedicated section tailored for hail damage insurance claims. We unravel the insurance landscape, guiding you through the crucial steps to take post-hailstorm. Discover the insider secrets to ensure your hail damage insurance claim gets the green light. From documenting the damage effectively to understanding the evaluation process, our guide empowers you with the knowledge needed to navigate the intricate world of insurance claims.

As you delve into our guide, uncover the reasons behind potential claim denials and gain insights into overcoming setbacks. If you find yourself facing hurdles, we address the burning question: Can you sue your insurance company for denying a hail property damage claim? What steps should you take if your claim processing is delayed? Our guide provides clarity on your options, empowering you to make informed decisions during the claims process.

Understanding the urgency of timelines, we shed light on the hail damage claim time limit for filing. Delve into the complexities of insurance regulations, ensuring you meet the necessary deadlines for a swift resolution. Finally, discover why Ethen Ostroff Law stands as your unwavering partner in securing the compensation you rightfully deserve. Our commitment to your success in the hail damage insurance claim process is unwavering.

We invite you to read the full article and uncover the intricacies of hail damage and insurance claims. Equip yourself with the knowledge needed to navigate challenges successfully, secure the compensation you rightfully deserve, and ensure you are prepared for any hailstorm that comes your way.

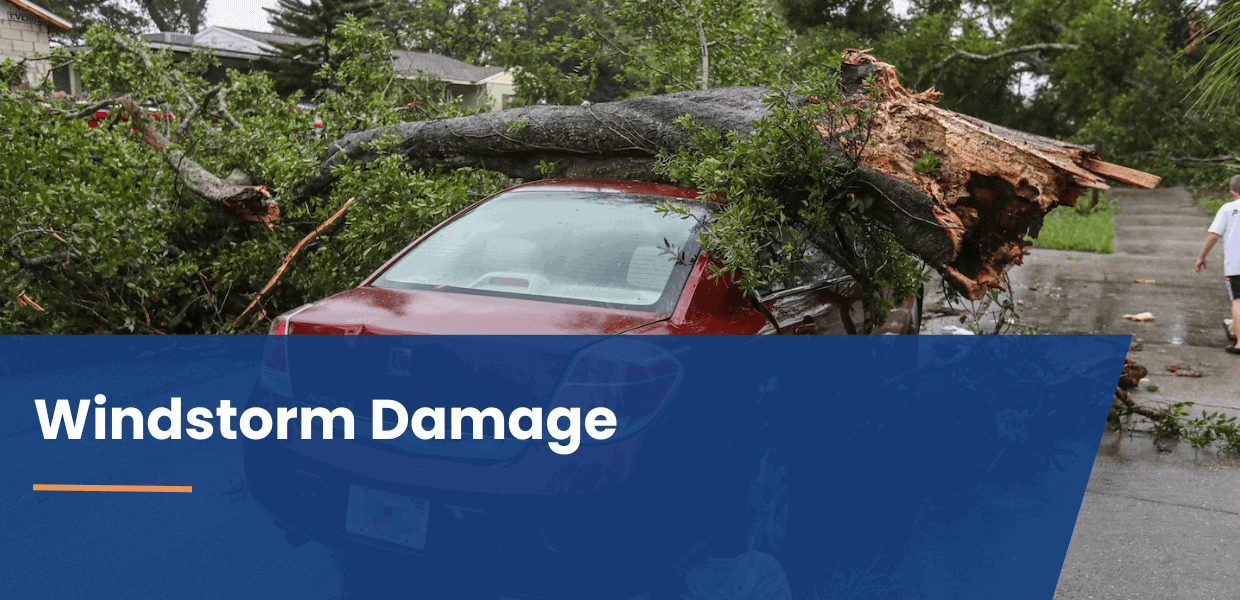

Your Comprehensive Guide to Wind Damage Claims

Managing the aftermath of windstorms requires addressing potential wind damage claims. Windstorms, characterized by strong winds and turbulent atmospheric conditions, pose a significant threat to properties, landscapes, and communities. These natural phenomena can result in widespread damage, ranging from fallen trees and power lines to structural harm to buildings. Wind damage, specifically, refers to the destruction inflicted on structures, homes, and belongings due to the force of the wind. Common manifestations include roof damage, broken windows, and compromised structural integrity. Wind damage severity can vary depending on factors such as wind speed, storm duration, and the resilience of the affected structures.

To mitigate the financial impact of wind damage, individuals and businesses often turn to wind damage insurance. In the realm of insurance, wind damage insurance plays a vital role in safeguarding individuals and businesses from the financial repercussions of wind-induced harm. This specialized insurance coverage is intended to provide financial protection and assistance with the repair or replacement of windstorm-damaged property. It covers a range of damages, including structural repairs, debris removal, and personal property losses.

Wind damage insurance claims come into play when policyholders seek compensation for the losses incurred during a windstorm. Navigating this claims process involves documenting the extent of the damage, communicating with the insurance company, and working through the assessment and settlement procedures. Successfully managing wind damage claims requires a comprehensive understanding of insurance intricacies, meeting documentation requirements, and adhering to specific timelines.

Ethen Ostroff Law plays a crucial role in assisting individuals and businesses dealing with wind damage claims. As your legal partner in insurance claims, we provide guidance and representation throughout the entire process. Our dedicated team at Ethen Ostroff Law helps clients understand the intricacies of wind damage insurance, ensuring they are equipped to navigate the complexities of the wind damage claim process successfully. From documenting the damage to negotiating with insurance companies, we stand as advocates for those seeking fair and just compensation in the aftermath of wind damage.

So, hop on and step into the nuanced world of wind damage insurance claims with Ethen Ostroff Law, your trusted ally in navigating the aftermath of potent windstorms. Uncover the essentials of wind damage claims, gaining insights into the nature of windstorms, common types across the United States, and geographical hotspots susceptible to these atmospheric forces.

Explore our practical advice on straightforward windstorm preparedness, equipping you with the knowledge to safeguard your property. Delve into the diverse forms of windstorm damage and understand crucial aspects of insurance coverage crafted specifically for wind-related perils. Learn actionable steps to take if your property faces wind damage and follow our detailed guide on filing a wind damage insurance claim. Unravel the complexities of resolving a denied wind damage claim as we outline common reasons behind denials and how Ethen Ostroff Law can champion your case. Why do wind damage claims face denial? What sets Ethen Ostroff Law apart in handling windstorm damage claims? These are the questions we address, providing you with the knowledge needed to make informed decisions during challenging times.

Ready to equip yourself with insights on wind damage insurance claims? Read on and choose Ethen Ostroff Law as your guide to claiming calm after a windstorm.

Hurricane Damage Insurance Claim: Your Essential Guide

In the aftermath of a hurricane, confronting the potential for hurricane damage insurance claim requires a profound comprehension of the unique challenges posed by these formidable storms. Hurricanes, colossal tropical cyclones characterized by powerful winds and substantial rainfall, wield the potential to inflict extensive damage on communities, landscapes, and structures. Their impact spans from structural harm to buildings and homes to the devastation of landscapes and essential infrastructure.

Hurricane damage insurance plays a crucial role in providing financial protection against the aftermath of these storms. This specialized insurance coverage is designed to address repair or replacement costs for structures, homes, and assets affected by hurricanes. Managing hurricane damage insurance claim involves documenting the extent of the damage, engaging with insurance companies, and navigating the claims assessment and settlement processes. Understanding the intricacies of insurance regulations, meeting documentation requirements, and adhering to specific timelines are essential for successfully navigating these claims.

Ethen Ostroff Law stands as a dedicated advocate for those facing the challenges of hurricane insurance claims. Embark on a comprehensive journey through the tumultuous world of hurricane damage claims with us. Our guide, “Hurricane Damage Insurance Claims: Your Comprehensive Guide,” delves into the intricacies of navigating the aftermath of hurricanes in the United States.

Explore the dynamics of hurricanes and discover the most hurricane-prone states; arm yourself with crucial hurricane preparedness tips; and uncover the various forms of hurricane damage that can leave you grappling with financial uncertainties. Our guide goes beyond the storm, providing invaluable insights into understanding hurricane insurance coverage and the essential steps to take for a swift recovery post-disaster.

Take a step-by-step journey through the process of filing a hurricane damage insurance claim as we break down the requirements and deadlines crucial for a successful claim. Uncover common challenges faced in hurricane damage claims and equip yourself with knowledge on the tactics insurers employ to deny claims. Unravel the reasons behind denied claims and present the next crucial steps to take after facing a hurricane insurance claim denial. Finally, discover the power of engaging the services of hurricane insurance lawyers at Ethen Ostroff Law, your trusted partners in navigating the complexities of hurricane damage claims.

Don’t be left in the wake of uncertainty—read our comprehensive guide to hurricane damage insurance claims and take control of your financial recovery.

Ethen Ostroff Law's Insights on Bad Faith Insurance Claim

Understanding the intricate realm of insurance claims, specifically the critical aspect of bad faith insurance claims, is essential. Unraveling the complexities surrounding insurance practices and bad faith insurance can empower you with essential knowledge. Insurance claims, the process by which policyholders seek compensation for covered losses, are founded on the principle of good faith and fair dealing between insurers and insured parties. However, bad faith insurance practices involve insurers acting unreasonably or unfairly in handling these claims, breaching the implied covenant of good faith and fair dealing present in insurance contracts.

Bad faith insurance practices can manifest in various ways, adversely affecting policyholders. Unjust claim denials, delayed claim processing, inadequate investigations, and refusal to communicate effectively are some examples of such practices. These actions can have severe consequences for policyholders, causing financial distress and emotional hardship and hindering the recovery process after a loss. At Ethen Ostroff Law, we understand the detrimental impact of bad faith insurance practices on policyholders, and we are committed to providing unwavering support and legal guidance.

Unlock the secrets of bad faith insurance claims with Ethen Ostroff Law, your trusted partner in navigating the intricate landscape of insurance practices. Dive into our guide, “Understanding Bad Faith Insurance Claim: A Comprehensive Guide,” where we unravel the complexities surrounding bad faith insurance and empower you with the knowledge needed to protect your rights.

Explore the concept of bad faith insurance and delve into the “implied covenant of good faith and fair dealing” inherent in insurance contracts. Learn the key points associated with this implied covenant and understand the duty of good faith that insurers owe to policyholders. Our guide goes beyond theory; it equips you with the tools to recognize bad faith insurance practices and provides real-world examples across different insurance claims.

Discover best practices to prevent bad faith insurance claims and gain insights into responding to unfair insurance tactics. Explore the legal options available when faced with bad faith insurance practices, including the process of filing a lawsuit and the associated time limits. We guide you through the essential steps in proving bad faith in an insurance claim and building a robust case.

At Ethen Ostroff Law, our bad faith insurance attorneys are committed to seeking justice for our clients. Uncover the consequences that insurance companies may face for engaging in bad faith practices and learn about the compensation available in a bad faith insurance claim. We also delve into alternative dispute resolution options to resolve bad faith insurance claims efficiently.

Don’t navigate the complexities of bad faith insurance claims alone. Choose Ethen Ostroff Law, your dedicated partner in legal matters, to ensure your rights are protected. Read our comprehensive guide to empower yourself with bad faith insurance claims and discover how our bad faith insurance lawyers can advocate for you.

Maximize Recovery: Ethen Ostroff Law's Home Damage Insurance Claim Handbook

The process of filing a home damage insurance claim can be daunting, especially when unforeseen disasters strike. At Ethen Ostroff Law, we recognize the challenges that homeowners face in the aftermath of such events. Our article, “Maximizing Compensation: Ultimate Guide to Home Damage Insurance Claim in 2023,” serves as your indispensable resource in navigating the complex terrain of homeowners insurance claims.

In the initial sections, we lay the groundwork by providing a clear understanding of homeowners insurance. From exploring different policies to dissecting the protection they offer against various types of damages, we empower you to make informed decisions about your coverage.

The heart of the guide revolves around the homeowners insurance claim process. Starting with understanding the essentials, we guide you through the systematic filing of a claim. From assessing the situation and reporting the incident to cooperating with home insurance adjusters, each step is demystified, ensuring you are well-prepared for a successful resolution.

Thorough documentation is key to expediting the claims process, and our guide delves into the essential documents needed for a seamless experience. We shed light on the role of home insurance adjusters, the statute of limitations, and the importance of timely reporting, emphasizing the proactive measures that can significantly impact the outcome of your claim.

Understanding the timeframe for processing home insurance claims is crucial, and we provide insights into the factors influencing this timeline. Minimizing wait times and optimizing the response time for claims are discussed, offering practical tips for homeowners.

Delays in home insurance claims are not uncommon, and our guide explores common causes, such as challenges in assessing damage value and errors in filing. By highlighting potential pitfalls and common errors in the claims process, we equip you with the knowledge to navigate these hurdles successfully.

Denials of homeowners insurance claims can be disheartening, but our guide doesn’t leave you without recourse. We take you through the appeal process, offering steps to take when faced with claim denial and ensuring you have the tools to pursue a fair resolution.

In the unfortunate event of a dispute that cannot be resolved through conventional means, our guide outlines the homeowners insurance claim lawsuit process. Gain insights into when and how to take legal action, ensuring you’re well-prepared if negotiations fail to reach a fair settlement.

Discover the significant advantages of hiring a home insurance claim attorney for your home insurance claims. From legal expertise to negotiation skills, an attorney for home insurance claims can be a valuable asset in ensuring your rights are protected. Choosing the right attorney is a crucial decision. We provide tips on selecting an attorney with the expertise and dedication needed for your specific case. Finally, we delve into the intricacies of compensation in homeowners insurance claims. Going beyond visible property damage, we explore additional aspects, such as emotional distress and loss of use, ensuring a comprehensive assessment of your losses.

As you navigate the complexities of home damage insurance claims, our guide serves as your trusted companion, offering not only legal expertise but also compassionate support. At Ethen Ostroff Law, our mission is to empower you to rebuild not only your property but also your life. Dive into our guide and discover how we can help you maximize compensation in the aftermath of home damage.